Profits season occurs each and every 3 months. That is when firms percentage main points on their contemporary monetary efficiency, which is helping traders know the way the corporate is working.

Firms record those reviews as a result of they have got to. Below SEC laws, they’re required to take action inside 45 days of the top of the quarter.

Buyers can spot tendencies within the reported information. They are able to additionally use the numbers to decide whether or not a inventory is a purchase or promote.

Analysts additionally take note of the reviews. They use that information to replace their fashions. Well timed information will have to assist analysts supply correct forecasts. Then again, that doesn’t precisely occur.

A Conventional Profits Season

The newest quarter used to be standard. Over three-quarters of businesses within the S&P 500 Index beat analysts’ expectancies. In most cases, about 15% pass over expectancies. In a median quarter, lower than 10% of businesses ship revenue equaling the estimate.

Those are essentially the most broadly adopted firms on the planet. But analysts virtually at all times underestimate revenue. During the last 20 quarters, an reasonable of 77% of businesses beat expectancies in 1 / 4. Over 10 years, the typical beat price is 73%.

Even if they’re flawed, revenue estimates are helpful.

All of the ones mistakes don’t in reality quantity to a lot. For the firms within the S&P 500 Index, all the ones revenue beats higher revenue via about 4.8%.

Reported revenue for the second one quarter are $54.80, up $2.50 from the estimate when revenue season began. That’s a bit underneath reasonable. Usually, revenue beat estimates via a median of 6.4%.

Profits for the S&P 500 aren’t the sum of the revenue for the firms within the index. Effects are weighted via the scale of the inventory. Apple (Nasdaq: AAPL) carries essentially the most weight within the S&P 500, about 7.6%. That quantity of its revenue are carried out to the index revenue determine.

We will use estimated revenue to seek out value goals for the index.

Discovering Worth Goals for S&P 500

For the top of 2023, analysts be expecting S&P 500 revenue of $219.41. Profits in 2024 are anticipated to be $244.06.

A value-to-earnings (P/E) ratio supplies a worth goal. The present P/E ratio for the index is set 20.5. That’s close to the long-term reasonable. The ten-year reasonable is 20.3. The 25-year reasonable is nineteen.95.

In response to 2024 revenue and a median P/E ratio, the associated fee goal is 5,003, about 2% upper than the present value.

However the P/E ratio has been a lot upper than reasonable. The 25-year top is 30.7. At that stage, the associated fee goal is 7,492, a acquire of greater than 53%.

The P/E ratio may be less than reasonable. The 25-year low is 11.95. That yields a worth goal of two,916. That’s 40% less than the place we at the moment are.

The usage of revenue estimates, we see that costs may just transfer considerably upper or decrease. The path of the fashion relies on sentiment.

For now, sentiment is bullish. That issues to probably upper costs.

Regards,

Michael CarrEditor, Precision Earnings

Michael CarrEditor, Precision Earnings

Retail Gross sales Stories Display How “Actual The united states” Is Doing

I’ve been overlaying the plight of the American shopper for weeks now, and we have now an actual treasure trove of recent information to kind thru…

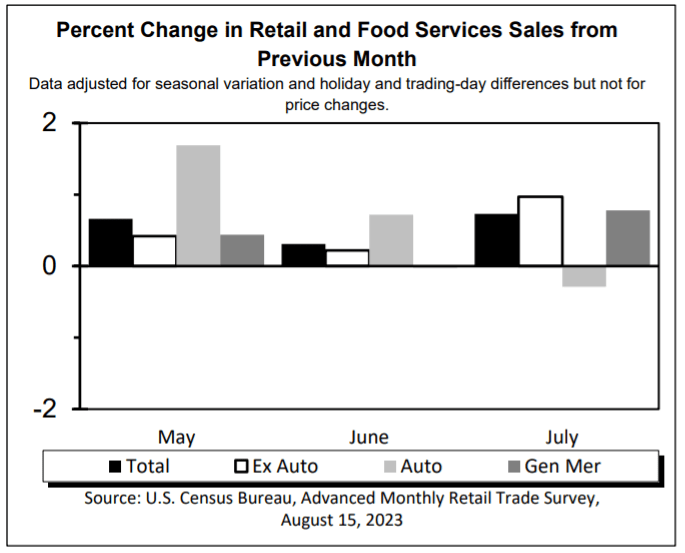

Let’s get started with the retail gross sales record for July. To start with look, it didn’t glance too shabby. Overall retail gross sales had been up 0.7% over June and up 3.2% over July of remaining 12 months.

In fact, the ones numbers aren’t adjusted for inflation.

And inflation has been operating warmer than 3.2% during the last 12 months.

However whilst this expansion isn’t powerful, the numbers don’t appear to color an image of the American consumer sheathing their bank cards both.

Digging deeper, the numbers get extra fascinating…

Furnishings retail outlets noticed gross sales down 6.3%, and electronics retail outlets and residential growth retail outlets noticed shrinkage of three.1% and three.3%, respectively.

And what do those have in not unusual?

They’re all associated with the house.

With those top loan charges, American citizens are transferring much less, and are subsequently purchasing much less.

Now, the actual brilliant spot at the record used to be in eating places and bars, the place spending used to be up just about 12% over remaining 12 months.

Once more, a few of that is inflation, however in no way it all. American citizens, regardless of feeling the pinch, are nonetheless playing dinner and beverages clear of house.

How “Actual The united states” Is Navigating the Economic system

Goal, the retail retailer, additionally launched its revenue this week.

That is one thing I learn each and every quarter. If you wish to see how Primary Boulevard American citizens are doing on this financial system, learn the quarterly reviews of Goal and Walmart.

After which pay attention to what control is pronouncing.

That is mainstream, mass-market The united states and you’ll be able to steadily see tendencies forming right here prior to they display up in govt statistics, months later…

Neatly, the inside track popping out of Goal isn’t nice. The store slashed its estimates for the rest of the 12 months. It indicated that buyers are specializing in must haves and delaying their purchases of discretionary pieces.

However there used to be one remark via Michael Fiddelke, Goal Leader Monetary Officer, that were given my consideration:

“The resumption of pupil mortgage repayments is one of the components that we’re gazing in reality carefully.”

Sound acquainted?

I’ve been caution about this for months.

Economics is an workout in what folks do with that subsequent marginal greenback. If the price of your elementary must haves has risen via a greenback, then it’s one greenback much less you may have to be had to spend somewhere else or save.

Therefore, Goal’s feedback that upper grocery costs imply much less cash to spend on garments and home items.

The standard pupil mortgage cost is any place from $200 to $500 per thirty days. Neatly, wages aren’t robotically emerging via $200 to $500 per thirty days. So once more, that implies that each and every greenback spent on debt reimbursement is a greenback popping out of different spending.

Now, I discussed the day prior to this that Warren Buffett is implicitly making a bet at the American shopper, by way of his $700 billion funding in homebuilders (and in addition bank card issuers).

But additionally take into accout this: Infrequently segments of the inhabitants do smartly, even whilst different segments in reality battle.

I’ll be keeping track of this, as I be expecting this tug-o-war in conflicting financial information will proceed to create alternatives for us for the remainder of this 12 months — particularly in temporary buying and selling methods.

Mike Carr is knowledgeable relating to this sort of buying and selling: environment friendly, focused, with a focal point on top quality investments. If you wish to be informed extra about what he’s operating on in his Industry Room, cross right here for extra main points.

Regards, Charles SizemoreLeader Editor, The Banyan Edge

Charles SizemoreLeader Editor, The Banyan Edge