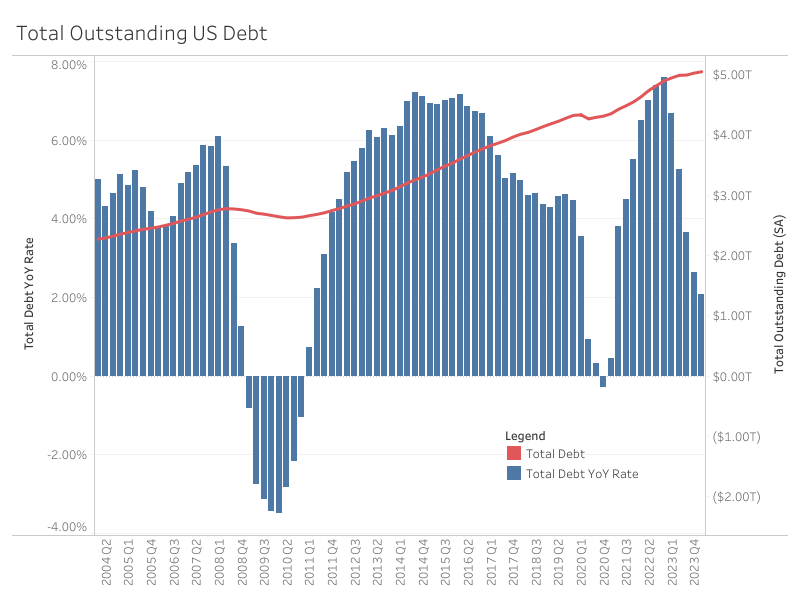

General exceptional US debt stood at $5.05 trillion for the primary quarter of 2024, expanding at an annualized charge of one.86% (SA), in keeping with the Federal Reserve’s G.19 Shopper Credit score Document. From the primary quarter of 2023 to the primary quarter of 2024, the full larger by way of 2.09%. That is less than the 6.67% year-over-year (YoY) upward push from Q1 2022 to Q1 2023, and the 6.51% YoY upward push from Q1 2021 to Q1 2022.

Nonrevolving and Revolving Debt

Of the full exceptional US debt within the first quarter of 2024, the nonrevolving percentage is 73.47%, with revolving at 26.53%. Nonrevolving debt, essentially made up of pupil and auto loans, stands at $3.71 trillion (SA) for the primary quarter of 2024. Revolving debt, which is essentially made up by way of bank card debt, stands at $1.34 trillion.

Each nonrevolving and revolving debt have slowed since families’ pandemic-era financial savings have dwindled. Relating to YoY enlargement, each nonrevolving and revolving debt peaked within the fourth quarter of 2022 at 15.10% and 5.34% respectively. Within the first quarter of 2024, the YoY enlargement charge for nonrevolving debt lowered to 7.93%, with revolving debt falling to 0.13%. Each skilled their 5th consecutive quarterly decline in YoY enlargement.

Scholar and Auto Loans

Breaking down the parts of nonrevolving debt, pupil loans account for 47.24%, and auto loans make up 41.88% (the G.19 record excludes actual property loans). The collective different loans make up the remainder 10.87% of nonrevolving debt.

Scholar loans within the first quarter of 2024 totaled $1.75 trillion (non-seasonally adjusted), marking the 3rd consecutive lower of one.31% over the 12 months, following an annual lower of one.97% within the earlier quarter. The 3rd quarter of 2023 marked the primary YoY lower for pupil mortgage debt because the information used to be first reported.

Auto loans for the primary quarter of 2024 had been at $1.55 trillion (NSA). Auto mortgage YoY enlargement has incessantly decelerated during the last 5 quarters. The fourth quarter of 2021 noticed a top of a 13.74% YoY enlargement in comparison to the primary quarter of 2024 YoY enlargement charge of two.41%. This decelerate partly displays upper auto charges, which lately sit down at 8.22% (60-month new automobile loans).

Uncover extra from Eye On Housing

Subscribe to get the newest posts in your e-mail.