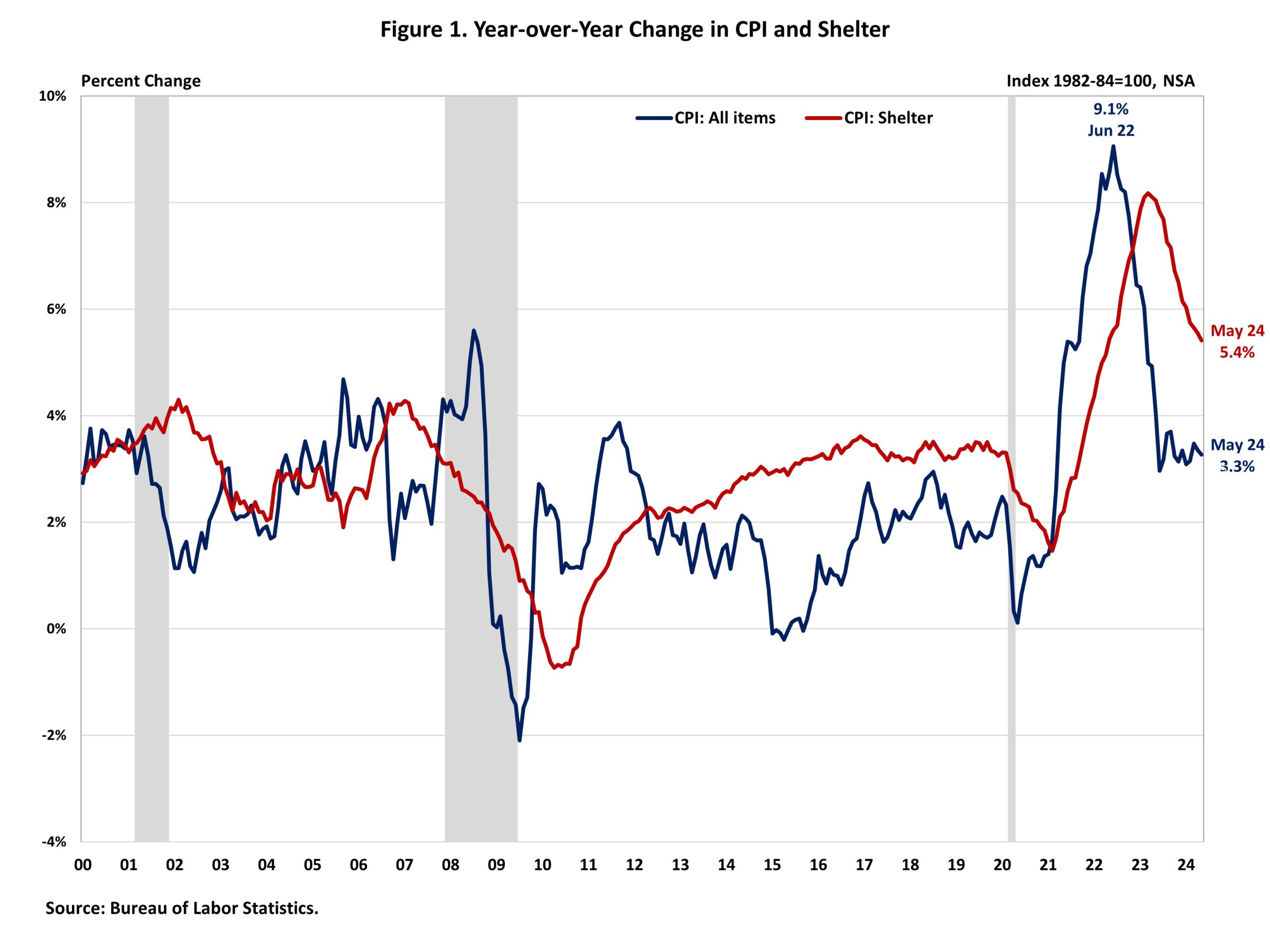

Each total and core inflation persevered to ease in Might as decline in fuel value offset the rise the refuge price. It is a dovish sign for long term financial coverage.

In spite of a slowdown within the year-over-year building up, refuge prices proceed to position upward drive on inflation, accounting for over 60% of the overall building up in core inflation. Whilst this document signifies indicators of softening costs, the Federal Reserve would require additional information to substantiate a constant disinflation pattern towards their 2% goal sooner than making an allowance for price cuts.

The Fed’s skill to deal with emerging housing prices is restricted as a result of will increase are pushed by way of a loss of inexpensive provide and lengthening building prices. Further housing provide is the principle option to tame housing inflation. On the other hand, the Fed’s gear for selling housing provide are constrained.

Actually, additional tightening of financial coverage would harm housing provide as a result of it could building up the price of AD&C financing. This can also be observed at the graph beneath, as refuge prices proceed to upward push regardless of Fed coverage tightening. However, the NAHB forecast expects to look refuge prices decline additional within the coming months. That is supported by way of real-time information from non-public information suppliers that point out a cooling in hire expansion.

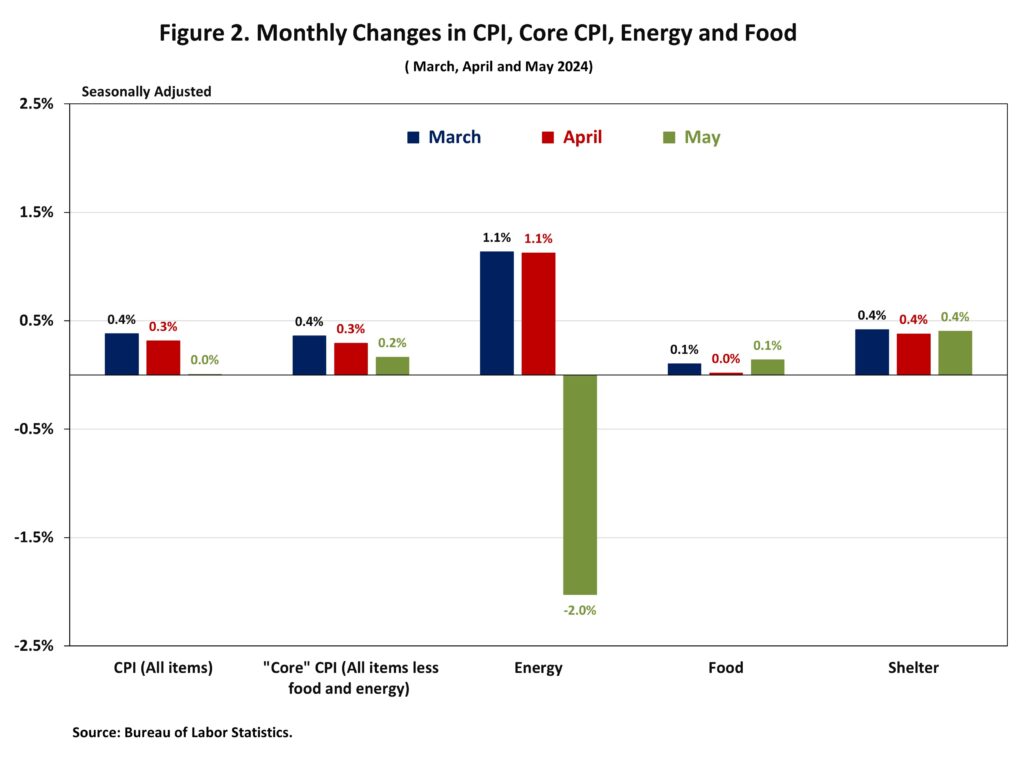

The Bureau of Hard work Statistics reported that the Shopper Value Index (CPI) used to be unchanged in Might on a seasonally adjusted foundation, after a nil.3% building up in April. With the exception of the risky meals and effort elements, the “core” CPI higher by way of 0.2% in Might, after a nil.3% building up in April.

The associated fee index for a wide set of power resources fell by way of 2.0% in Might, led by way of a three.6% lower within the fuel index. Different power indexes akin to herbal gasoline and gas oil declined 0.8% and zero.4%, respectively, whilst the electrical energy index used to be unchanged. In the meantime, the meals index rose 0.1% , after being unchanged in April. The index for meals clear of house higher 0.4%, whilst the index for meals at house remained unchanged in Might.

In Might, the index for refuge (+0.4%) persevered to be the biggest contributor to the per 30 days upward push within the core CPI. Amongst different most sensible individuals that rose in Might come with indexes for hospital therapy (+0.5%), used vehicles and vehicles (+0.6%) and schooling (+0.4%). In the meantime, the highest individuals that skilled a decline in Might come with indexes for airline fares (-3.6%), new automobiles (-0.5%), conversation (-0.3%) sport (-0.2%) and attire (-0.4%).

The index for refuge makes up greater than 40% of the “core” CPI. The refuge index rose by way of 0.4% for the fourth instantly month and the remained biggest issue within the per 30 days building up within the index for core inflation. Each the indexes for homeowners’ an identical hire (OER) and hire of number one place of dwelling (RPR) higher by way of 0.4% over the month, identical building up in April. Those beneficial properties were the biggest individuals to headline inflation in fresh months.

Throughout the previous three hundred and sixty five days, on a non-seasonally adjusted foundation, the CPI rose by way of 3.3% in Might, following a three.4% building up in April. The “core” CPI higher by way of 3.4% during the last three hundred and sixty five days, following a three.6% building up in April. This used to be the slowest annual acquire since April 2021. During the last three hundred and sixty five days, the meals index rose by way of 2.1%, and the power index higher by way of 3.7%. This marks the 3rd consecutive month of year-over-year will increase for the power index since February 2023.

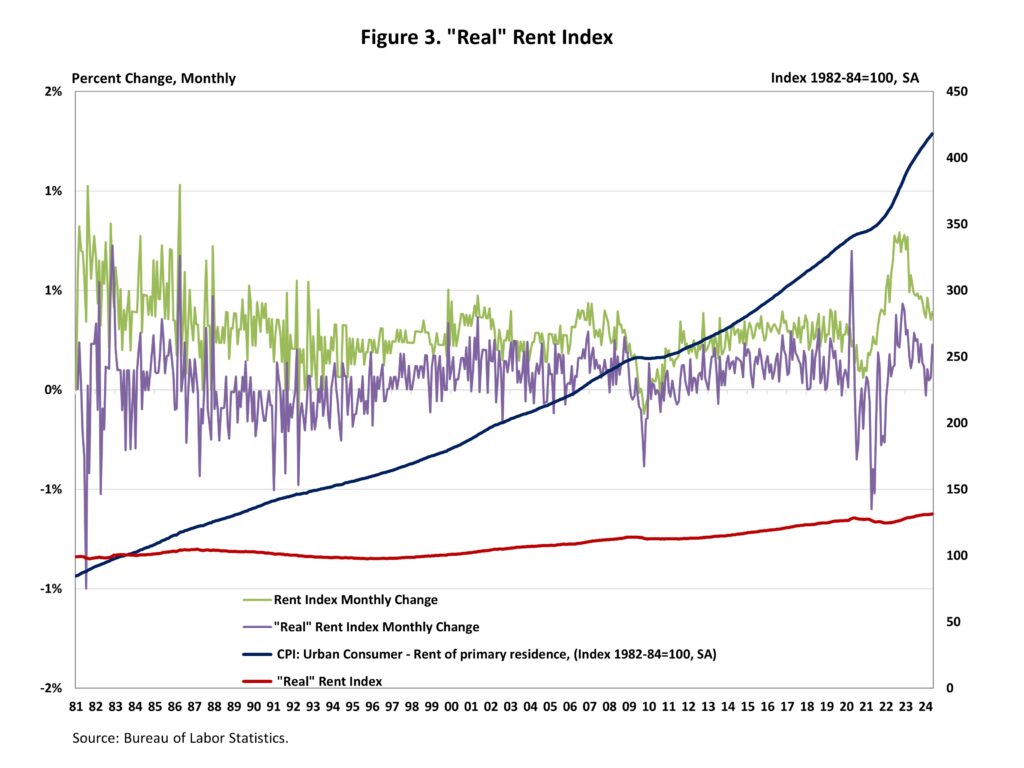

NAHB constructs a “genuine” hire index to suggest whether or not inflation in rents is quicker or slower than total inflation. It supplies perception into the provision and insist stipulations for condo housing. When inflation in rents is emerging quicker than total inflation, the true hire index rises and vice versa. The true hire index is calculated by way of dividing the cost index for hire by way of the core CPI (to exclude the risky meals and effort elements).

In Might, the Actual Hire Index rose by way of 0.2%, after a nil.1% building up in April. Over the primary 5 months of 2024, the per 30 days expansion price of the Actual Hire Index averaged 0.5%, slower than the common of 0.6% in 2023.

Uncover extra from Eye On Housing

Subscribe to get the newest posts on your e mail.