Let’s discuss the way to practice for and take out a pupil mortgage. Whether or not you wish to have a Federal pupil mortgage, or a non-public pupil mortgage, there are particular issues you wish to have to find out about the way to take out a pupil mortgage.

Whilst it might be nice to hide your whole university prices the usage of a mixture of financial savings, lend a hand from members of the family, scholarships, and your individual source of revenue, the ones finances aren’t all the time going to chop it. Many college-bound scholars will wish to practice for pupil loans to hide the distance between the price of schooling and their restricted assets.

This information explains the way to practice for pupil loans, and the way to make a choice the volume to borrow when you’re taking out the loans.

A excellent start line: How To To find The Best possible Pupil Mortgage Charges >>

The way to Observe for a Federal Pupil Mortgage

For U.S. electorate making use of for academic loans within the U.S., the FAFSA software is the place to begin for Federal pupil loans. Right here’s the way you practice for Federal pupil loans.

Standards And Necessities For A Federal Pupil Mortgage

In the event you’re having a look to get a federal pupil mortgage right here’s the factors:

- Have a sound Social Safety quantity.

- Males should be registered with the selective carrier. Male scholars between 18-25 need to sign up with the selective carrier to obtain loans.

- Be a citizen or eligible noncitizen. Undocumented immigrants don’t seem to be eligible to obtain federal or state investment. Everlasting citizens with inexperienced playing cards can practice for support. Immigrants with T-1, battered-immigrant-qualified alien, or refugee standing will also be eligible.

- Have a highschool degree or an identical, reminiscent of a GED or certificates from a homeschooling program.

- Join in an eligible college. Scholars at unaccredited colleges may now not qualify for federal support. Some colleges additionally select to not obtain federal support.

- Fill out the Unfastened Utility for Federal Pupil Assist. Any prime schooler fascinated with monetary support must fill out the FAFSA, a kind that asks to your circle of relatives’s monetary data to decide how a lot you qualify for. Even the ones with little to no demonstrated want can also be eligible for pupil loans, so officials inspire everybody to use. With out the FAFSA, you received’t obtain any federal loans, scholarships or grants.

- Be in excellent status with federal monetary support. Scholars can’t be in default on different federal loans or owe cash on a federal grant.

- Take care of a 2.0 GPA. Scholars wish to handle a 2.0 cumulative GPA or chance shedding monetary support till their grades reinforce.

- Be at part-time standing or extra. Scholars should be regarded as part-time to be eligible for loans. Each and every university determines what part-time and full-time standing manner, so ask your monetary support officer what number of credit you’ll wish to take.

Fill Out the FAFSA

Making use of for Federal pupil loans begins by way of filling out the Unfastened Utility for Federal Pupil Assist (FAFSA). To fill out the applying, you’ll want your data and your oldsters’ data from tax submitting from two years in the past (for the 2024-2025 college yr, you’ll want the 2022 tax returns), plus details about your oldsters’ property, your property, and different monetary main points.

Whenever you put up the FAFSA, your college (or colleges of selection when you’re nonetheless deciding the place to wait) will create a pupil support file for you. This file will come with details about loose support (reminiscent of grants, scholarships, and extra). It is going to additionally display details about work-study choices and, after all, pupil loans.

In the USA, virtually all colleges use the FAFSA to factor need-based support to scholars. Despite the fact that you don’t plan to take out pupil loans, you will have to be finishing the FAFSA. Chances are you’ll be informed that you simply qualify for grants or further scholarships out of your college of selection according to your monetary standing.

Overview the Assist Be offering from Your College

About two weeks after you put up the FAFSA on your college, you’ll be able to be expecting to obtain an support be offering. The be offering will come with details about all assets of support together with:

Basically, you wish to have to take the entire loose cash you’ll be able to get. That suggests accepting the scholarships and the grants. In the event you plan to continue to exist campus, you could need to imagine taking the work-study be offering too.

On the other hand, imagine work-study as a baseline to your income, now not a cap. Regularly, work-study jobs don’t pay really well. Aspect hustles like reffing football or basketball, tutoring, ready tables and tending a bar, or any type of professional exertions normally pay a lot better.

And, after all, beginning a industry is also one of the best ways to make cash all through university.

The ultimate type of support will probably be pupil loans. Those will come with backed loans, that have a decrease rate of interest (and passion doesn’t accrue when you’re at school), and unsubsidized loans (the place passion begins accruing instantly).

Learn our complete information to paying for school right here >>

Take Out The Suitable Pupil Mortgage Quantity

Whenever you overview the be offering, you’ll be able to settle for any a part of the be offering you wish to have. You don’t need to take out the entire loans. Actually, I like to recommend borrowing as low as imaginable to pay to your tuition and different prematurely prices. You additionally need to content material with federal pupil mortgage borrowing limits, which can be very low.

Between financial savings, frugal dwelling, and dealing, maximum undergraduate scholars will pay for his or her dwelling bills with out borrowing cash.

Pupil loans aren’t loose cash. You’ll have to pay them again. It all the time is smart to search for choices to borrowing to pay to your schooling.

It’s going to appear good to borrow a bit further now, however I counsel in opposition to that. After university, you could have a wage of $50,000 to $60,000 to start out (and even decrease in lots of fields). That feels like some huge cash, however paying again $50,000+ of pupil loans on a starter wage is a large problem.

Take into accounts your long run self, and restrict your borrowing these days. You may additionally need to remember to whole the pupil mortgage front counseling first so you’ve gotten a excellent working out of the expectancies for compensation.

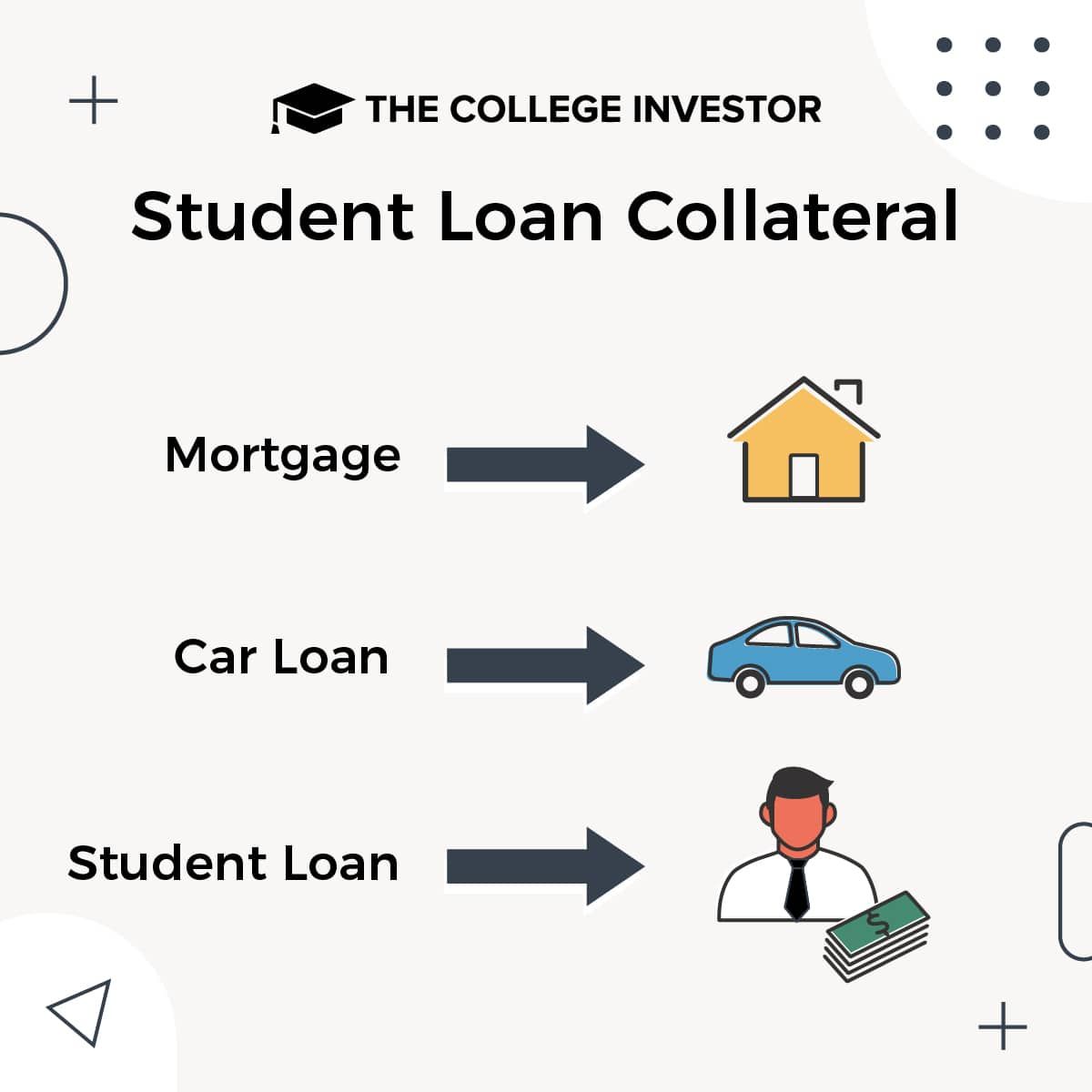

After all, take into account that the collateral for pupil loans is your long run income!

The way to Observe for Personal Pupil Loans

In some circumstances, scholars within the U.S. might need to practice for personal pupil loans slightly than Federal pupil loans. A couple of causes to imagine non-public loans come with:

- You wish to have to wait a non-accredited instructional alternative (reminiscent of a coding bootcamp).

- You propose to take one route at a time (you wish to have no less than half-time enrollment to qualify for many Federal systems).

- You’re now not a U.S. citizen, so that you don’t qualify for Federal loans.

- You have got a powerful source of revenue and a powerful credit score rating, so non-public lenders might be offering higher charges than the unsubsidized Federal loans.

- You’re refinancing your current pupil loans to a non-public lender with a considerably decrease rate of interest.

If this type of eventualities applies to you, then apply those steps beneath to use for personal pupil loans.

Accumulate All Your Paperwork

Whilst you practice for any mortgage, you’ll want paperwork to turn out your source of revenue, credit score rating, and whether or not you’ve gotten property. Basically, you’ll want the next:

- Tax returns or W-2 paperwork from the former years.

- Employment pay stubs.

- Non-public id data (driving force’s license, and so forth.).

- Financial institution statements.

- In the event you’re making use of for personal loans whilst attending college, you’ll want details about the price of attending.

- You probably have a cosigner, you’ll want their data too.

- Mortgage paperwork for current pupil loans (if refinancing).

Examine Charges from a Few Lenders

Whenever you’ve accumulated up the ideas, get started doing a little mortgage buying groceries. We propose the lenders on our Best possible Puts To To find Personal Pupil Loans listing.

Many lenders will let you preview charges with no need a troublesome credit score pull. You’ll be able to additionally “store” for charges the usage of websites like Credible.

Evaluating charges the usage of an aggregation website (like Credible) will let you get a really feel for the rates of interest and phrases to be had to you.

Observe for Equivalent Loans from at Least Two Lenders

After unofficially evaluating charges, practice for loans from no less than two lenders. That means you’ll be able to select the most efficient imaginable rate of interest. The underwriting and approval procedure can take any place from a couple of hours to a couple of weeks relying at the lender.

Consider to additionally evaluate key options like mortgage compensation phrases, mortgage discharge choices (like incapacity discharge), and extra.

Take Out The Best possible Pupil Mortgage Be offering

If in case you have a couple of mortgage gives in hand, evaluate them to peer which mortgage is the right for you. Then signal the mortgage paperwork and transfer ahead along with your schooling or paying off your loans.

You probably have a cosigner, you may additionally need to get a time period existence insurance plans to give protection to your cosigner will have to anything else occur to you. A time period existence insurance plans for the mortgage stability (when you are a tender grownup) can also be very affordable.

Consider, some non-public pupil loans require instant bills, so remember to double-check your lender and their compensation plans earlier than you dedicate.