Yves right here. This publish incorporates a cautious and credible research of ways marked deviation from customary temperature ranges (right here within the scorching route in Mexico) will increase default ranges, which then ends up in constrained lending for a time period later on. The have an effect on is granular, at the municipal point quite than nation-wide. The authors be offering some tips, basically at the credit score/monetary entrance, however there isn’t a lot you’ll be able to to do ameliorate decrease crop yields and employee productiveness.

Through Sandra Aguilar-Gomez, Assistant Professor of Economics Universidad De Los Andes. In the beginning printed at VoxEU

A contemporary file from the Global Panel on Local weather Alternate finds a constant upward push in excessive warmth days, affecting agriculture and past. Financial repercussions come with decreased labour productiveness and higher operational prices. Fresh research additionally emphasise local weather’s monetary sector have an effect on, particularly in low- and middle-income economies. This column delves into Mexican monetary vulnerabilities, revealing the hyperlink between excessive warmth and higher delinquency charges, in particular amongst small and medium-sized enterprises. Coverage will have to deal with those dangers, coupling local weather resilience with enhanced credit score get entry to for inclined companies.

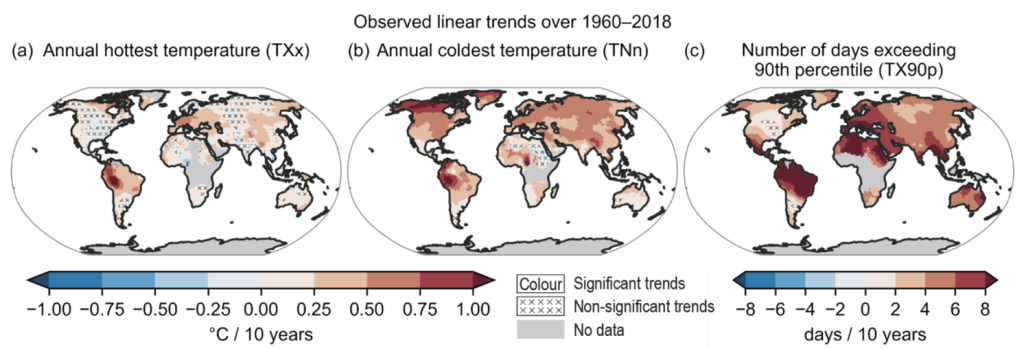

Local weather alternate is anticipated to extend the frequency and depth of utmost climate occasions. Heatwaves are a rising worry, each and every yr breaking temperature data (IPCC 2021). Determine 1 shows analyses of the newest evaluate file of the Global Panel on Local weather Alternate (IPCC AR6). All through the previous part a century, there was a constant building up within the collection of days above the ninetieth percentile of the native distribution. In agriculture, it’ll now not come as a wonder that analysis has discovered that crop yields are negatively impacted via deviations from optimum stipulations for plant enlargement. Alternatively, the industrial affects of a warming global prolong past the rural sector: prime temperatures make paintings ugly and make some items and services and products extra sexy than others. Top temperatures additionally make other people extra competitive and worse at making choices. Economists have discovered that those affects translate into companies’ earnings via decreased labour productiveness, higher employee absenteeism, and shifts in native call for. Operational prices additionally upward push if companies spend sources to mitigate a few of these affects (for instance, the use of extra air-con and shorter shifts for exhausted employees). In a contemporary Vox column, Ponticelli et al. (2023) speak about empirical findings of plant productiveness lowering with temperature in the USA, main within the medium run to smaller crops final, expanding focus within the production sector.

Determine 1 Linear developments over 1960–2018 for 3 temperature excessive indices: Annual most day by day most temperature (panel a), annual minimal day by day minimal temperature (panel b), and annual collection of days when day by day most temperature exceeds its ninetieth percentile from a base length of 1961–1990 (panel c)

Supply: IPCC (2021) Determine 11.9.

Central banks and different monetary establishments are more and more involved concerning the have an effect on of those shocks at the monetary sector (Reinders et al. 2023). The impact of damaging climate on prices and insist would possibly create liquidity shortages for companies that might motive solvency issues. In growing international locations, a number of stipulations counsel that companies could also be extra inclined. Assume, as an example, the defaults generated via the surprise building up lenders’ uncertainty about debtors’ talent to pay off their loans someday. If so, they could price upper rates of interest for brand spanking new loans and cut back credit score availability, expanding companies’ credit score constraints. That is particularly related for credit score sorts for which the facility to pay off is extra unsure, comparable to new small and medium-sized enterprises (SMEs) with scarce credit score historical past, or for companies wanting funding loans, that have longer adulthood and better uncertainty about long run earnings that the funding would generate. General, the have an effect on of impartial and identically dispensed shocks might be longer-lived when hitting credit score markets that deal much less successfully with informational asymmetries comparable to the ones in low- and middle-income economies.

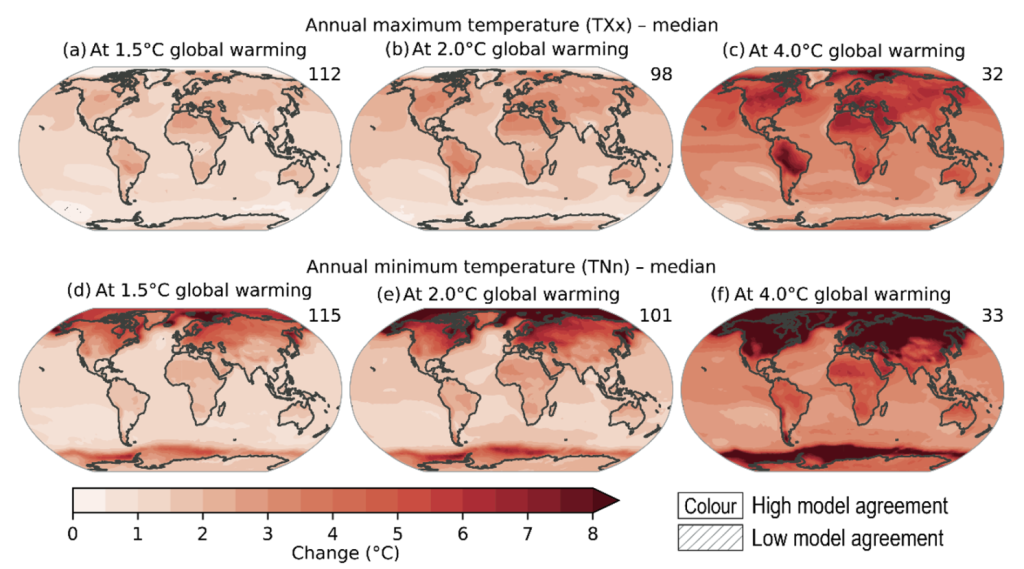

Additionally, it is very important word that warming isn’t projected to impact international locations homogeneously. Maximum growing international locations are in areas with upper baseline temperatures. Therefore, even uniform warming can have disparate affects because of laborious organic limits for agricultural yield and human well being. Alternatively, present fashions mission important heterogeneity in native warming, as proven in Determine 2. For all of the causes above, figuring out the affects of utmost climate occasions at the monetary sector in growing international locations is of prime coverage relevance.

Determine 2 Projected adjustments in annual most temperature (panels a to c) and annual minimal temperature (panels d to f) at 1.5°C, 2°C, and four°C of worldwide warming in comparison to the 1850–1900 baseline

Supply: IPCC (2021) Determine 11.11.

In our fresh learn about (Aguilar-Gomez et al. 2024), my co-authors and I make use of a powerful technique and a complete dataset encompassing knowledge on all loans prolonged via business banks to non-public companies in Mexico over a span of just about a decade. This permits us to delve into possible local weather vulnerabilities throughout the Mexican monetary gadget. In particular, we estimate the have an effect on of sudden days above the ninety fifth percentile of the temperature distribution on companies’ monetary misery, with our number one center of attention at the delinquency fee, measured because the ratio of non-performing loans to general exceptional credit score in a county.

Our learn about finds 3 major findings:

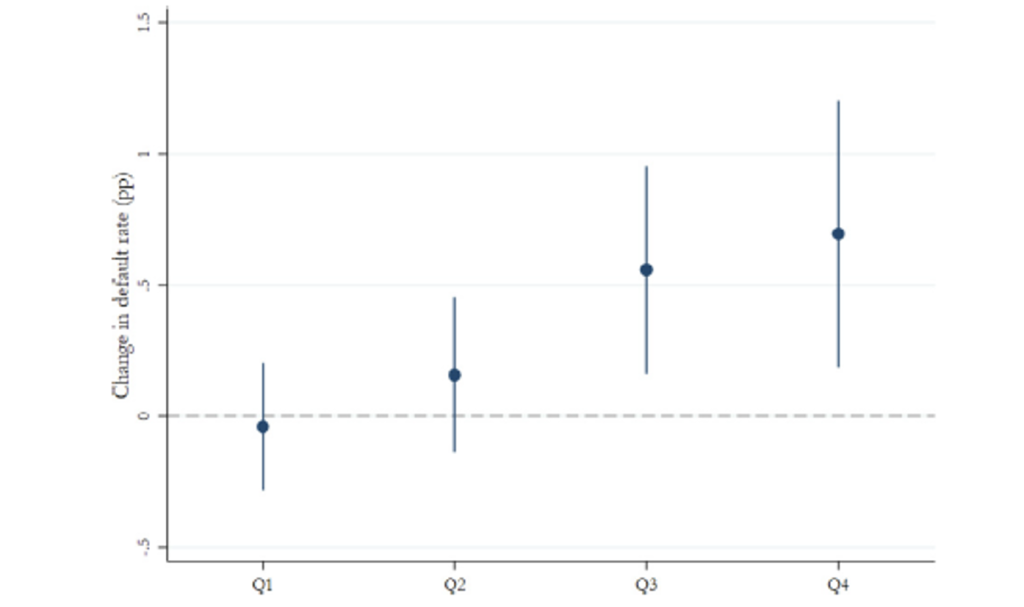

- Excessive warmth in a municipality raises its credit score delinquency fee, an impact pushed solely via small companies defaulting on their loans. When it comes to magnitudes, ten odd days of utmost warmth all through the former 3 months building up the delinquency fee of SMEs via 0.17 proportion issues, similar to 4.4% of the noticed pattern imply (3.9%). Determine 3 shows this phenomenon via plotting the connection between the default fee and the times of utmost warmth within the earlier quarter. It additionally presentations that the heatwave needs to be lengthy sufficient to motive important harm (i.e. 11 days). This discovering is in keeping with the perception that SMEs in growing international locations are much less provided to deal with excessive temperatures, making it tougher to get entry to additional credit score in occasions of economic rigidity. In step with principle and former analysis (e.g. Schlenker and Roberts 2009, Blanc and Schlenker 2017), we discover that the adverse impact of utmost warmth is more potent in agriculture.

- Regional financial composition issues. Excessive warmth additionally has sizeable results on non-agricultural industries in areas with a sufficiently huge percentage of agricultural employees. Moreover, results within the non-agricultural sector are concentrated in services and products and retail, this is, non-tradable sectors that depend closely on native call for. The findings counsel that hostile stipulations in agriculture result in decreased native spending, inflicting spillover results into non-agricultural industries.

- Through using various marketplace integration measures in agriculture manufacturing, we discover that climate shocks have a more potent impact on credit score default amongst agricultural companies in additional built-in markets. This result’s in keeping with the perception {that a} value surge partly offsets a lower in native manufacturing brought about via excessive climate in additional remoted markets. Apparently, this proof means that monetary establishments could also be much less susceptible to temperature shocks in slightly remoted markets.

- One may well be much less serious about those effects if our knowledge indicated that companies get well and don’t raise longer-run implications of short-run shocks. We discover that temperature shocks cut back the collection of companies with get entry to to credit score within the affected municipality for a while. Credit score composition additionally adjustments after the elements surprise: we discover a lower in credit score for investments and new companies, along side a upward push in rates of interest for brand spanking new loans. In particular, publicity to excessive warmth interprets into higher rates of interest for brand spanking new loans inside of the similar agency, heightened collateral necessities, and declined credit score get entry to. In combination, the firm- and market-level effects display that in line with shocks, banks tighten credit score for 2 to a few quarters, hindering get entry to to monetary flexibility when companies maximum want it. Those findings distinction with the ones present in complicated economies, in particular the USA, the place the proof means that companies use credit score strains to control liquidity all through excessive climate (Brown et al. 2021, Collier et al. 2020). Mexican SMEs appear not able to make use of new loans in a similar fashion.

Determine 3 Results of utmost temperatures on delinquency charges

Our findings supply empirical reinforce to the worries in regards to the possible results of utmost climate at the monetary gadget described, as an example, in Reinders et al. (2023). Based on gathering proof, regulatory government, and central banks international are calling for enhancements in measuring and tracking local weather dangers, such that related actors can set up such dangers (Litterman et al. 2020). One coverage implication of our effects is that insurance policies in the hunt for to cut back direct publicity to local weather shocks in banks’ steadiness sheets would preferably be carried out along side different complementary insurance policies, particularly in growing international locations. Such insurance policies may make amends for unintentional penalties via deepening small and medium companies’ get entry to to credit score, particularly when companies are dealing with the have an effect on of climate shocks.