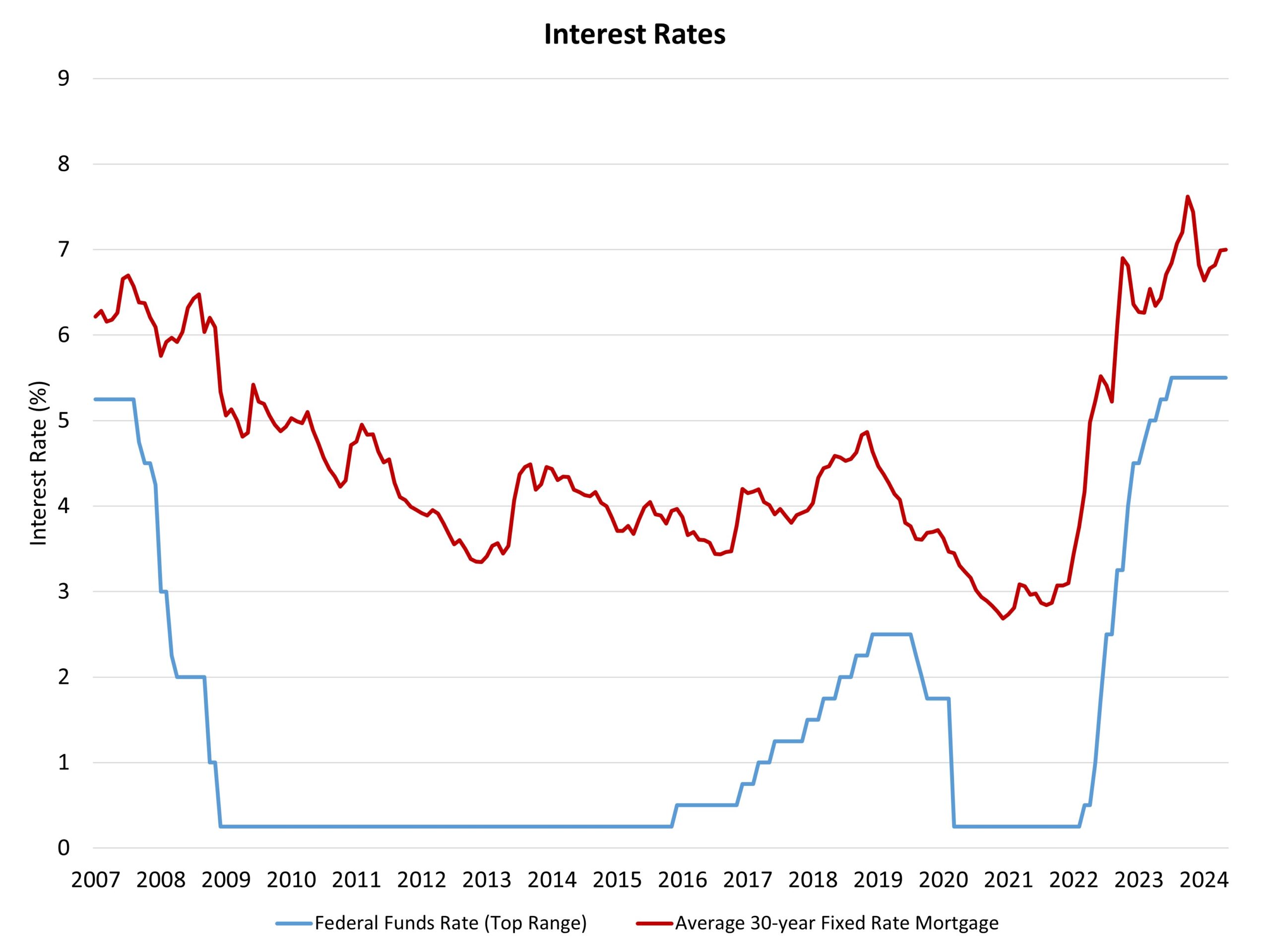

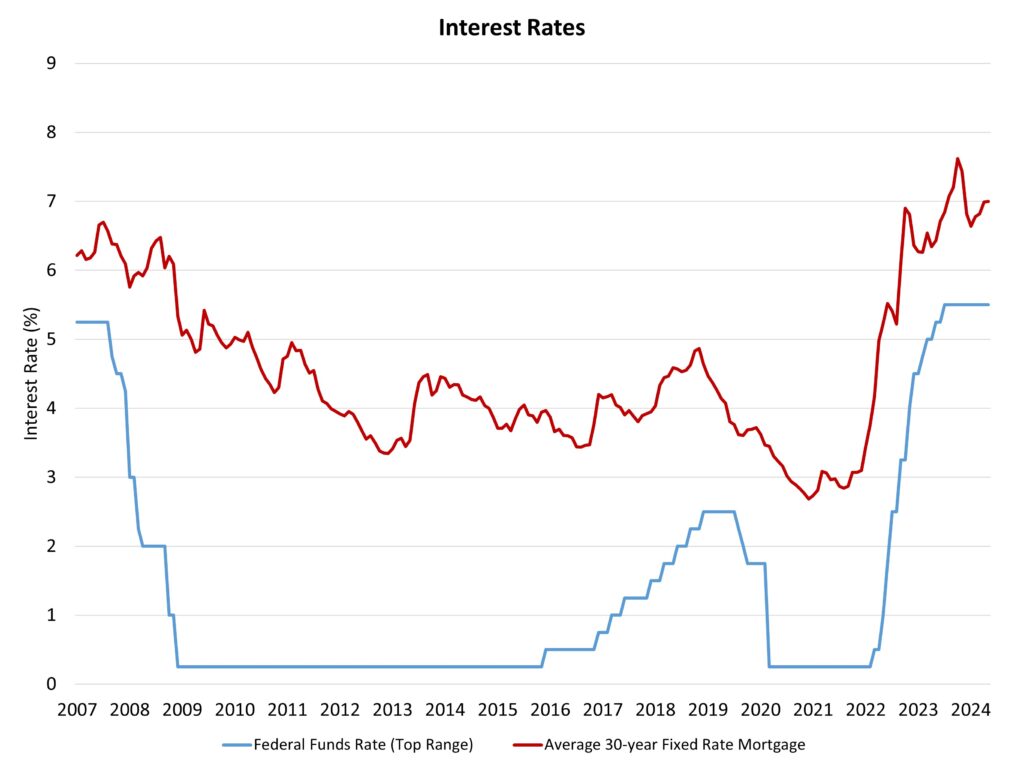

The Federal Reserve’s financial coverage committee held consistent the federal budget charge at a most sensible goal of five.5% on the conclusion of its June assembly. In its remark, the Federal Open Marketplace Committee (FOMC) famous:

Fresh signs counsel that financial process has persisted to increase at a forged tempo. Activity beneficial properties have remained robust, and the unemployment charge has remained low. Inflation has eased during the last yr however stays increased. In contemporary months, there was modest additional growth towards the Committee’s 2 % inflation goal.

In comparison to the Fed’s Would possibly remark, the present remark upgraded “loss of growth” said in Would possibly to “modest additional growth” referred to this month with appreciate to attaining the central financial institution’s 2% inflation goal. The FOMC’s remark additionally famous (in step with its remark in Would possibly):

The Committee does now not be expecting it is going to be suitable to cut back the objective vary till it has won better self assurance that inflation is shifting sustainably towards 2 %.

Total, the central financial institution continues to search for sustained, decrease inflation readings, with the information having proven inadequate growth throughout the primary quarter. The Would possibly CPI knowledge used to be a step in the fitting route, however the central financial institution will stay knowledge dependent with appreciate to an eventual easing of financial coverage.

Crucial reason why for the loss of contemporary inflation relief stays increased measures of refuge inflation, which is able to most effective be tamed within the long-run through will increase in housing delivery. Paradoxically, upper rates of interest are fighting extra development through expanding the price and proscribing the provision of builder and developer loans essential to build new housing.

Chair Powell famous the demanding situations for housing within the present setting. He said that the “housing scenario is sophisticated.” He indicated that the most efficient factor the Fed may just do for the housing marketplace could be “to deliver inflation down, in order that we will deliver charges down.” Alternatively, Chair Powell famous that “there’ll nonetheless be a countrywide housing scarcity as there used to be ahead of the pandemic.” We agree. The housing marketplace calls for non-monetary coverage lend a hand at the supply-side of the business, together with hard work drive building and zoning reform, to handle the housing scarcity.

The Fed additionally revealed new financial projections with the realization of its June assembly. Those projections come with a consensus expectation of only one charge lower in 2024, in step with NAHB’s present financial forecast. Whilst this can be a relief in charge cuts from the March outlook, the coverage bias is obviously towards decrease charges within the near-term, now not charge hikes. The projections divulge that the Fed does now not be expecting to totally succeed in its 2% inflation goal at the core PCE inflation measure till 2026.

The remainder of the Fed’s macro forecast used to be moderately unchanged. The Fed is anticipating a 2.1% GDP expansion charge (year-over-year for the fourth quarter) for 2024 and a pair of% for 2025. The Fed’s outlook for hard work markets stays tough in spite of tighter monetary prerequisites. The forecast is for a upward push in unemployment to simply 4.2% for the general quarter of 2025.

A notable trade used to be made to the Fed’s long-run projection for the federal budget charge. The March forecast noticed a long-run federal budget charge of two.5% to a few.1%. This used to be higher within the June outlook to a 2.5% to a few.5% vary. Whilst this can be a theoretical measure, it does mirror a metamorphosis within the Fed’s considering referring to financial expansion. As a result of this charge vary higher, and the Fed’s long-run GDP expansion forecast didn’t build up, it signifies that the Fed expects upper charges might be wanted within the years forward to care for moderately impartial financial coverage within the theoretical long-run.

Within the short-run, the NAHB Economics staff’s focal point remains to be at the interaction between Fed financial coverage and the refuge/housing inflation element of total inflation. With greater than part of the whole beneficial properties for client inflation because of refuge during the last yr, expanding possible housing delivery is a key anti-inflationary technique, one this is sophisticated through upper non permanent charges, which build up builder financing prices and impede house development process. For those causes, coverage motion in different spaces, reminiscent of zoning reform and streamlining allowing, can also be necessary techniques for different parts of the federal government to combat inflation.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts for your e-mail.