Assessment

Because the call for for blank applied sciences grows, so too does the call for for high-tech rechargeable batteries to energy the fairway financial system. On the other hand, the US and the Ecu Union’s present dependence on Japan, South Korea and China for 80 p.c of the arena’s battery manufacturing is threatening their auto trade. As the biggest processor and manufacturer of those battery fabrics, China on my own can considerably affect pricing and provide chain flows.

America and the Ecu Union are operating to scale back dependence on those international locations and restructure provide chains. Each areas have known Canada as a safe and solid supply of sustainable uncooked fabrics, similar to lithium, which is important to the rising electrical car marketplace. Consequently, mining corporations with Canada-based tasks that provide fabrics wanted for high-tech rechargeable batteries similar to lithium is also a fascinating alternative for buyers to believe.

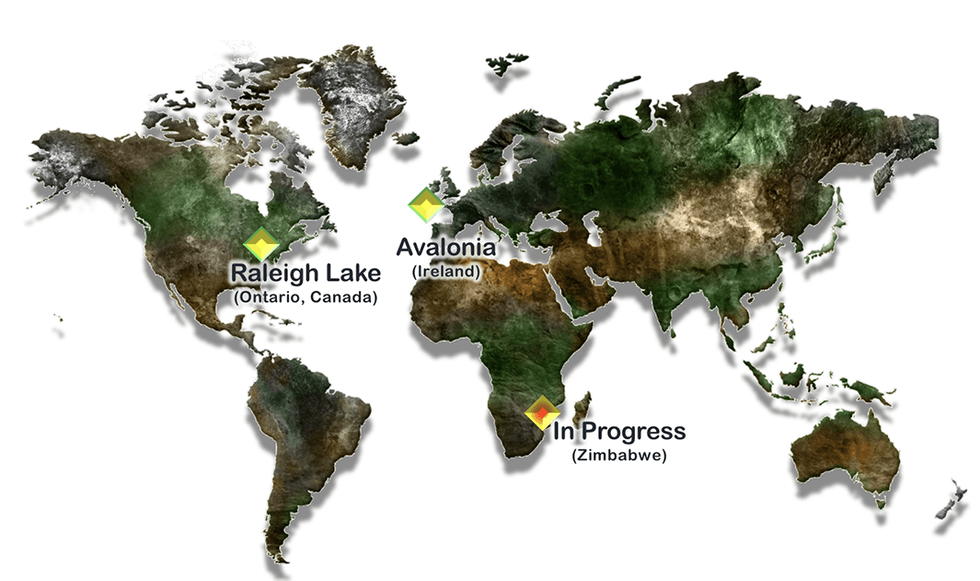

World Lithium (TSXV:ILC,OTC:ILHMF,FRA:IAH,OTCQB:ILHMF) is a mineral exploration corporate all in favour of growing a portfolio of lithium and uncommon metals tasks and royalties in Canada and Eire. The corporate is led by means of an skilled control workforce with a confirmed observe file of advancing potential tasks with low technical possibility in established mining jurisdictions.

World Lithium delivers shareholder worth via venture construction, strategic partnerships and venture gross sales. The corporate’s tasks come with the Raleigh Lake and Avalonia tasks.

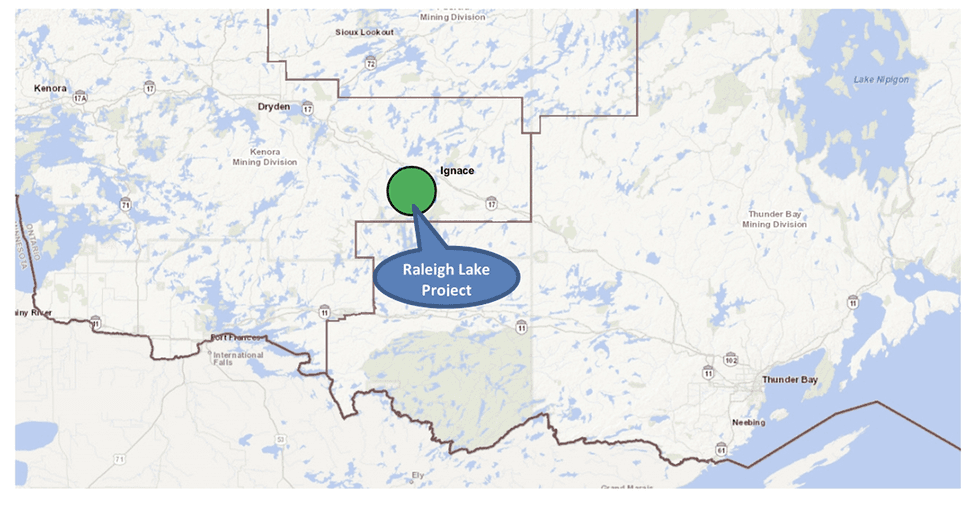

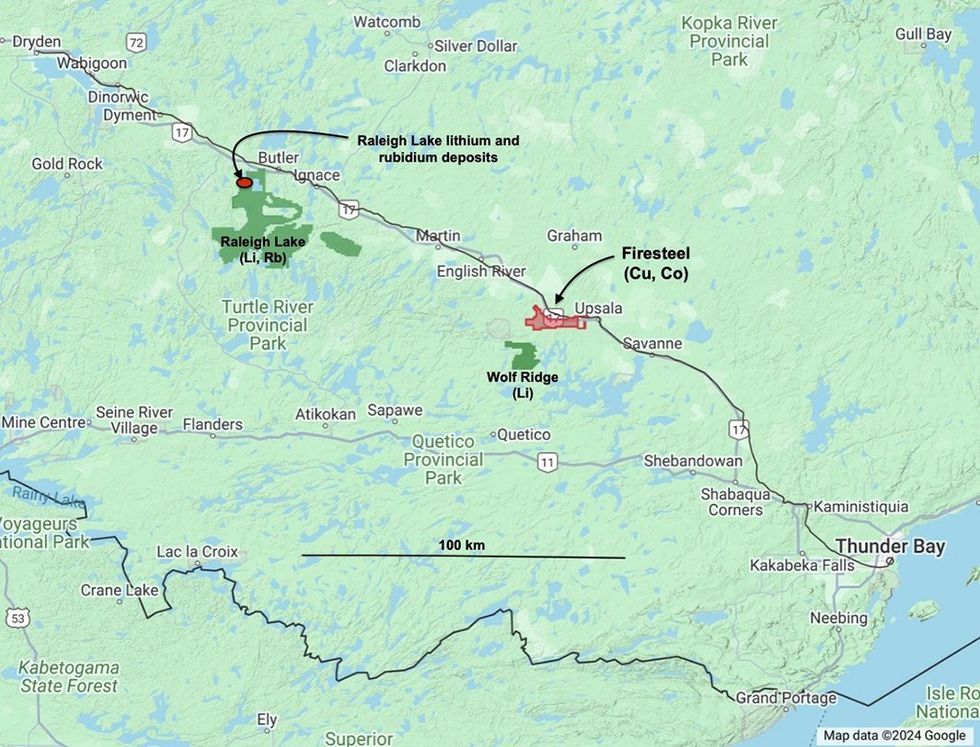

The corporate’s flagship Raleigh Lake venture is an entirely owned and extremely potential lithium, rubidium and caesium venture in Ontario. Raleigh Lake spans 48,500 hectares adjoining to the Trans-Canada freeway and CPR railway, simply out of doors town of Ignace, and contours promising drill effects. Drilling known stacked tabular dyke-like our bodies that delicately dip from floor, protecting a space of 600 meters alongside strike by means of 400 meters downdip with every dyke having grades corresponding to the three.78-meter period grading 1.72 p.c lithium oxide and a couple of,829 portions consistent with million (ppm) rubidium in drill hollow RL21-03. Prospecting on newly received claims came upon 20 new pegmatites at floor degree over a number of kilometers.

A sure initial financial evaluation for Raleigh Lake, launched in December 2023, displays an annual after-tax money go with the flow of C$634 million, NPV of C$342.9 million, IRR of 44.3 p.c.

World Lithium’s Avalonia venture is a three way partnership lithium venture situated in Leinster, Eire, spanning 29,200 hectares protecting a 50-kilometer belt. Drilling at the Avalonia venture returned 2.23 p.c lithium oxide over 23.3 meters together with 3.43 p.c lithium oxide over 6 meters and 1.50 p.c lithium oxide over 5.6 meters. The Avalonia venture is lately below an possibility settlement. World Lithium lately owns 45 p.c.

“World Lithium. is now in by means of some distance the most powerful monetary place that it’s been since its checklist in 2011, and we look ahead to development effectively on that each at our lithium and rubidium venture at Raleigh Lake in Ontario and on our different provide and long term tasks,” stated chairman and CEO John Wisbey.

In October 2021, the corporate bought its percentage within the Mavis Lake three way partnership lithium and caesium venture in Ontario to Important Sources (ASX:CRR) with proceeds totaling C$1.48 million and a imaginable additional C$1.38 million related to useful resource discovery milestones.

The corporate additionally bought its last pastime within the Mariana venture in Argentina for US$13.17 million, which has positioned World Lithium in a powerful monetary place to additional building up its liquidity. In 2021 on my own, the corporate raised C$4.9 million in fairness financing.

World Lithium is lately all in favour of growing its flagship Raleigh venture, however the corporate additionally continues to spot further houses to develop its portfolio. In February 2024, World Lithium entered into an settlement to obtain 90 p.c pastime within the Firesteel venture, a extremely potential grassroots copper and cobalt belongings in Northwestern Ontario, signaling a diffusion of the corporate’s essential minerals portfolio. The corporate completed the acquisition of the Firesteel belongings in Would possibly 2024 and has filed programs for lets in to habits the primary drilling program at Firesteel focused on copper mineralization and take a look at as much as six distinct goals with as much as 2,000 metres of core drilling.

Corporate Highlights

- World Lithium is growing a portfolio of lithium and uncommon metals tasks and royalties in Canada and Eire, aiming to ship shareholder worth via venture construction, strategic partnerships and venture gross sales.

- The corporate’s flagship Raleigh Lake venture is an entirely owned and extremely potential lithium, rubidium and caesium venture in Ontario, Canada.

- The corporate produced its maiden useful resource estimate for lithium and rubidium and has launched a favorable initial financial evaluation for Raleigh Lake.

- World Lithium has signed an settlement to buy 90 p.c pastime within the Firesteel venture, a extremely potential grassroots copper and cobalt belongings in Northwestern Ontario.

- The corporate’s 29,200-hectare Avalonia venture is a three way partnership lithium venture situated in a big belt in Leinster, Eire. Drilling at the venture returned 2.23 p.c lithium oxide over 23.3 meters together with 3.43 p.c lithium oxide over 6.0 meters and 1.50 p.c lithium oxide over 5.60 meters.

- Along Canada and Eire, World Lithium has known Zimbabwe as a strategic jurisdiction within the corporate’s international lithium technique.

- World Lithium is led by means of an skilled control workforce with a confirmed observe file of advancing potential tasks with low technical possibility in established mining jurisdictions.

Key Initiatives

Raleigh Lake

The flagship Raleigh Lake venture is a completely owned lithium, rubidium and caesium venture situated instantly west of Ignace in Ontario, Canada. The Raleigh Lake venture spans 48,500 hectares and is available by way of the Trans-Canada Freeway. The venture additionally options get entry to to the Canadian Pacific railway, herbal gasoline pipelines and a hydropower line that crosses in the course of the belongings.

Drilling at the belongings started in April 2021 and returned promising grades of lithium, sizable quantities of rubidium and small quantities of caesium. Drilling known mineralization hosted in no less than 4 major pegmatites and extra seen in outcrops. Drill effects come with 2.80 of lithium oxide over 9.0 meters in addition to 1.05 meters grading 2.69 p.c lithium oxide from 31.04 meters and 1.18 meters grading 4210 ppm rubidium from 29.86 meters inside of a three.78-meter period grading 1.72 p.c lithium oxide and 2829 ppm rubidium.

In 2021, World Lithium all in favour of comparing the regional possible for extra lithium-bearing pegmatites in and across the Raleigh Lake house and, because of this, has expanded the venture from 3,000 hectares to greater than 47,700 hectares, in keeping with research of regional geophysical and geological information.

Section 3 of the diamond drilling program, which started in September 2022 at Zone 1 of the Raleigh Lake Lithium venture intersected spodumene-bearing pegmatite, demonstrating super continuity of the mineralized frame.

Section 3 drill highlights

- All Section 3 holes trying out Pegmatite 1 in Zone 1 intersected spodumene-bearing pegmatite, demonstrating super continuity of the mineralized frame

- Thicker and higher-grade mineralization intersected nearer to the outside as expected.

- Section 1, 2 and three pierce issues have intersected Pegmatite 1 alongside a strike period of over 800 meters and alongside its dip for over 400 meters.

Pegmatite 1 Spodumene Zone Intersection Highlights*

- RL22-45: 4.85 meters grading 2.06 p.c lithium oxide in decrease spodumene zone (from 89.5 meters);

- RL22-48: 15.82 meters grading 2.25 p.c lithium oxide (from 65.56 meters);

- RL22-49: 2.21 meters grading 2.47 p.c lithium oxide (from 72.69 meters);

- RL22-50: 4.62 meters grading 2.29 p.c lithium oxide (from 56.12 meters);

- RL22-56: 2.96 meters grading 2.13 p.c lithium oxide (from 72.42 meters);

Pegmatite 1 Rubidium-bearing Microcline Intersection Highlights*

- RL22-45: 3.98 meters grading 1.21 p.c rubidium oxide from 85.52 meters;

- RL22-57: 4.69 meters grading 0.60 p.c rubidium oxide from 152.51 meters.

Maiden Mineral Useful resource Estimate

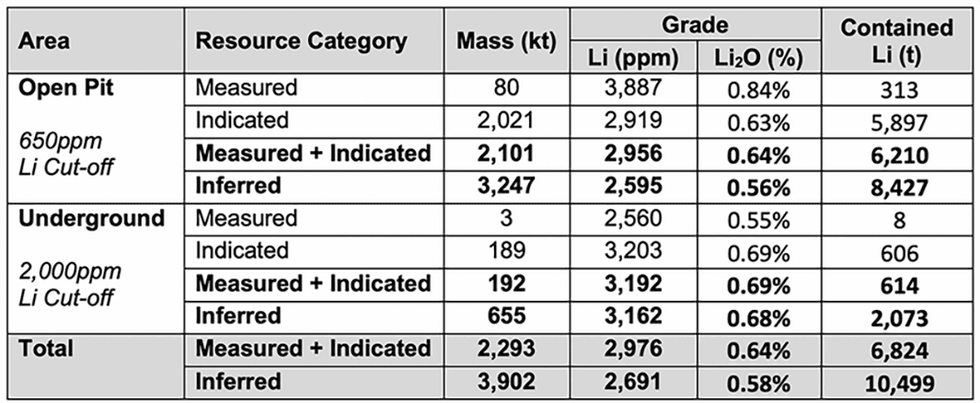

World Lithium launched its lithium and rubidium mineral useful resource estimates (MRE), that are intently comparable because of their spatial relationships, however their respective useful resource estimates are thought to be separate and distinctive.

Lithium MRE

It is a abstract of the lithium MRE for lithium-caesium-tantalum (LCT) pegmatites of the Raleigh Lake pegmatite box. The open pit and underground MREs are constrained by way of optimized pit shell and minable form wireframes, respectively.

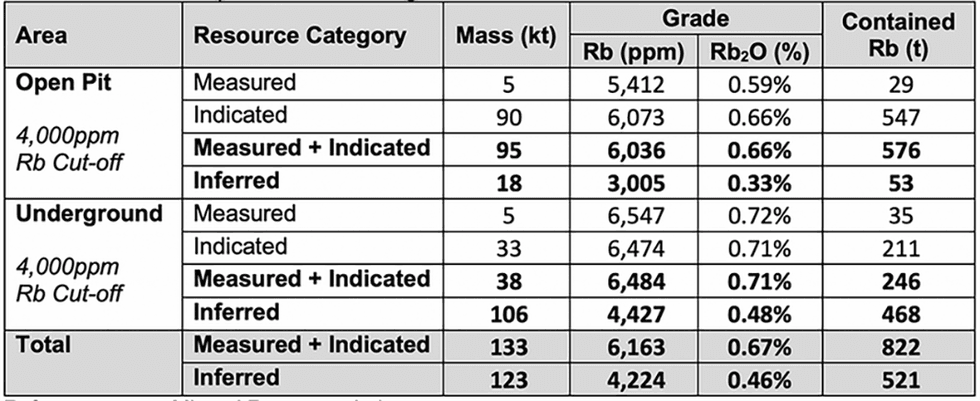

Rubidium MRE

An impartial MRE has been calculated for the rubidium contained inside of microcline zones of the LCT pegmatites. Rubidium additionally happens during the LCT pegmatites throughout the lithium-bearing spodumene at a decrease cutoff however isn’t incorporated on this rubidium MRE. Rubidium attaining grades more than 4,000 ppm is attributed to wallet of excessive modal abundance of microcline (potassic feldspar). The open pit and underground MREs are constrained by way of optimized pit shell and minable form wireframes, respectively.

Rubidium Open Pit and Underground MRE

In December 2023, World Lithium launched its sure initial financial evaluation (PEA) for a proposed lithium mining operation to provide spodumene pay attention at Raleigh Lake. The PEA has demonstrated a extremely beneficial financial situation in keeping with the manufacturing of a spodumene pay attention containing 6 p.c lithium oxide. Challenge economics display an after-tax money go with the flow of C$634 million, NPV of C$342.9 million and IRR of 44.3 p.c consistent with annum, with a nine-year mine lifestyles and venture length of eleven years.

Avalonia

Spodumene in boulder at Avalonia

The Avalonia venture is a three way partnership lithium venture situated in Leinster, Eire. The valuables spans 29,200 hectares protecting a 50-kilometer belt with round 29 important lithium pegmatite occurrences. Drilling at the Avalonia venture returned 2.23 p.c lithium oxide over 23.3 meters together with 3.43 p.c lithium oxide over 6.0 meters and 1.50 p.c lithium oxide over 5.60 meters. On the other hand, some drill effects at the belongings are nonetheless pending.

World Lithium lately owns 45 p.c of the venture whilst Ganfeng Lithium owns 55 p.c. Ganfeng Lithium has the technique to gain 79 p.c of the venture by means of spending C$10 million for exploration actions by means of September 2024 or by means of generating a favorable feasibility find out about. If the choice is exercised, World Lithium will retain 21 p.c of the Avalonia venture which might cut back additional if the corporate does no longer give a contribution to the venture. On the other hand, if the corporate’s possession turns into not up to 10 p.c then its percentage will convert to a 1 p.c NSR.

Firesteel Copper Challenge

The 6,600-hectare Firesteel belongings is composed of 17 mining claims, making up 316 mining declare gadgets in Northwestern Ontario. The valuables is adjoining to Freeway 17, not up to 10 kilometers west of Upsala, Ontario stretching westward to the Firesteel River for about 16 kilometers.

Firesteel is situated throughout the central Wabigoon Sub-province on the jap prohibit of the Lumby Lake Greenstone Belt, which accommodates large mafic flows or gabbro interspersed with skinny felsic meta volcanic and uncommon pillowed mafic gadgets. Historic assay effects from samples taken at places roughly 1.6 kilometers northeast and a couple of.8 kilometers southwest of the Roadside 1 Copper Zone returned values of as much as 2.6 p.c copper, 3.327 ppm gold and a couple of.6 p.c copper, 4.294 ppm gold, respectively (Bumbu 1995).

Control Group

John Wisbey – Chairman and CEO

John Wisbey joined the board of ILC in 2017. After a couple of months, he changed into deputy chairman after which he changed into chairman and CEO in March 2018. He has in my opinion invested important price range in ILC since becoming a member of the board and is now ILC’s biggest shareholder. He has had a occupation as a era entrepreneur and may be a former banker. Extra lately, Wisbey was once a inexperienced power entrepreneur. He based two London AIM-listed corporations –– IDOX plc which gives device for the United Kingdom native govt and Lombard Possibility Control plc which focuses on device for financial institution possibility control and legislation. He additionally established CONVENDIA Ltd. which is a non-public corporate that focuses on device for money go with the flow forecasting, venture valuation and M&A monetary research. Wisbey holds more than a few non-executive director roles in the United Kingdom and Switzerland. He was once previously a banker at Kleinwort Benson. At Kleinwort Benson, he held more than a few roles, together with a director within the derivatives staff, head of choices and company lending. Wisbey has acted as a public corporate chairman, CEO, or director for 20 years. He’s a graduate of Cambridge College.

Maurice Brooks – Director and CFO

Maurice Brooks joined the board of ILC in 2017. He’s a certified senior statutory auditor in the United Kingdom. Since 2000, he has been a senior spouse at Johnson Smith & Co. in Staines, Surrey. Sooner than that, Brooks was once a senior spouse in Johnsons Chartered Accountants within the London Borough of Ealing. His industrial and funding revel in comprises govt directorships in production and an funding accountant position to the superannuation fund of the Western Australian state govt. His early skilled employment comprises Ball Baker Leake LLP and LLC and Value Waterhouse Coopers-UK.

Anthony Kovacs – Director and COO

Anthony Kovacs joined the board of ILC in 2018 and has labored with the corporate since 2012. He has over 25 years of revel in in mineral exploration and construction. Sooner than becoming a member of ILC, he held senior control roles during which he sourced and complicated iron ore and business minerals tasks. Kovacs was once considering early-stage paintings on the Lac Otelnuk Iron Ore venture in Quebec, Canada and the Mustavaara Vanadium Mine in Finland. Sooner than that, Kovacs labored for Anglo American the place he all in favour of Ni-Cu-PGE and IOCG tasks. At Anglo-American, Kovacs was once without delay considering a number of discoveries the world over. Kovacs has important revel in with business minerals, ferrous metals, non-ferrous metals and valuable metals tasks during the Americas, Europe and Africa.

Ross Thompson – Non-executive Director

Ross Thompson joined the board of ILC in 2017 and is the chair of the audit and remuneration committees. He’s a speaker and professional in advertising and marketing behavioral science. In 1995, he based Giftpoint Ltd. which is now one of the crucial biggest specialist promotional products companies in the United Kingdom. with places of work in London and Shanghai. Giftpoint Ltd.’s purchasers come with L’Oreal, Oracle, Ocado and Pernod Ricard amongst others. Thompson was once president of IGC International Promotions, one of the crucial international’s oldest and biggest international networks of top class resellers, for seven years. He’s an lively investor with a different pastime and figuring out of herbal sources companies.

Geoffrey Baker, Non-executive Director

Geoff Baker joined the board of ILC on the finish of 2022, and is a member of the audit committee. He has a prominent occupation within the herbal useful resource and finance industries. He’s a director of Tim Buying and selling, an organization providing consultancy services and products within the oil and gasoline trade. All the way through his tenure as supervisor of Insch Black Gold Finances, Baker won the Traders Selection Swiss Fund Supervisor of the 12 months Award. He’s a co-founder of a virtual collectible non fungible token CryptoChronic and of Cannastore, a pilot e-commerce web site. Baker holds a bachelor’s stage from the College of Windsor in Ontario.